作者:Carlo Passeri & 杜杰 & 叶鹏

Carlo Passeri 先生为大岩资本姊妹公司Jasper Capital HongKong公司的产品和投资者关系主管。杜杰先生为大岩资本的执行总监、投资经理。叶鹏先生为大岩资本的总监、投资经理。原文标题为: The Case for an Integrated Alpha Model(统一超额收益模型之案例)。

編者按:

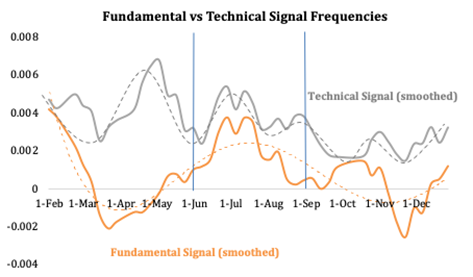

基本面信号、技术信号、事件驱动信号和另类信号是主要的投资策略信号类别。将多类信号统一于一个分析框架的超额收益模型,更有效地利用信息,会比单纯依赖某一种信号的模型更好。18年两次“入摩”标志性事件可以很好对基本面信号和技术信号进行事件发生前后的对比分析,进而观测事件驱动信号的影响及基本面信号和技术信号的表现差异。不难预期,交易量会在“入摩”具体实施日期前后出现增大的现象。交易量增大是获得超额收益的良机,根源在于A股市场散户交易行为与存在超额收益高度相关。这两次“入摩”事件分别伴随着贸易战以及市场低迷的背景,这也提供了观测不同市场环境下会发生何种变化的机会。

为便于原汁原味体现文章内容,敬请读者阅读下文。原文为Jasper Capital HongKong公司newsletter之2019-3月号文章,转载时略有删减。

The Case for an Integrated Alpha Model

Introduction

In this monthly, we attempt to explain the utility of our approach, which integrates fundamental, technical, and event-driven signals in a dynamic ratio.

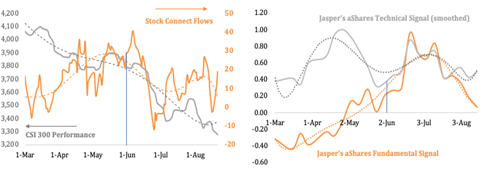

We use the two MSCI inclusion dates of June 1, 2018 and September 3, 2018 as key markers given that each date was supposed to be book-ended by inflows. For context, as investors have seen in similar index inclusions, ahead of each inclusion date there would be active managers attempting to front-run the tens of billions of dollars in passive flows that would follow. One would expect an uptick in trading volumes around each date, and therefore a positive impulse into alpha in the A-share market given the high correlation between retail trading volumes and alpha generation.

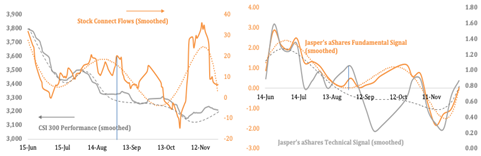

But these inclusions also happened in different market environments. The first happened in the throes of the trade war, when sentiment was rattled but still buoyant, and economic momentum remained robust, particularly following much better-than-expected growth data. Whereas the second inclusion occurred in the heart of the bear market when sentiment, price, and economic momentum were at their nadir. This offers the opportunity for us to understand what worked in different market environments given the same underlying assumption that flows should increase around the inclusion date.

The Concept

Our approach to building our quantitative framework has hallmarks of Daniel Kahneman and Amos Tversky's research on systems of thought and cognitive tendencies in decision-making. In his book, Thinking, Fast and Slow, Kahneman describes the dichotomy of two cognitive systems active in decision-making. One system is instinctive and emotional, and, therefore, faster. The other is more deliberate and logical, and, therefore, slower. This has its perfect equivalence in quantitative investing where technical signals capture the more emotional factors that change with high frequency, whereas fundamental signals capture the more logical factors that require some time to change.

The underlying logic of our framework lies in the contrast of Jasper Capital being a manager with a longer-term view than most, but also a manager that specializes in deploying quantitative methods to execute our views. For example, despite the economic slowdown and other externalities, China is still growing faster than most other rival economies. And despite the deteriorating macro backdrop and recent bear market, Chinese companies are still generating significant revenues and creating new market segments that have the possibility to be globally competitive (see TikTok).

This, philosophically, begets the need to maintain exposure to fundamental factors as they are slower to reprice. On the other end of the spectrum, however, we know that retail investors dominate onshore volumes, and are highly emotional in their tendencies. When things are good, there is not enough leverage to go around. When things are bad, there is perennially the punter waiting for Beijing to make things good again. These ups and downs occur at a rapid pace, magnified by rumors, economic data, company announcements, and policy/political headlines. We believe that being solely focused on fundamentals or solely focused on technical needlessly sacrifices returns.

How It Works

In practice, company fundamentals are a lot slower to reprice, particularly in China where the best companies still have leverage but also have higher asset turnover. This suggests that leverage is actually being invested. These companies also tend to have significant stockpiles of cash and wide moats. This means economic momentum and market prices are slower to affect balance sheets for these companies, creating higher latency signals that continue to perform even as emotional, but faster, technical signals vacillate. This was clearly demonstrated immediately following each MSCI inclusion when volumes dropped quickly, affecting technical signals as the evolution of flows and volumes are the substrate from which technical signals are developed. However, fundamental signals were buoyed by still strong macro data, a robust consumer, and foreign inflows.

Flows and Signals Around the First MSCI Inclusion

Flows and Signals Around the Second MSCI Inclusion

The duality of fast and slow reacting signals serves as ballasts to portfolio volatility and returns, particularly when sentiment and flows quickly fade. We found that the inflection point for fundamental signal performance happens when these quantitative and qualitative (sentiment) aspects of a bear market converge, particularly following a sustained external shock, such as the escalation of the trade war in tandem with signs of a cooling economy.However,our integrated approach provides more ways to maintain the consistency of alpha generation as we have found by using a combination of latencies across technical, fundamental, and event-driven signals.

深圳市福田区益田路5033号平安金融中心88层01单元

上海市浦东新区陆家嘴街道富城路99号 (震旦国际大楼)27层

香港中环德辅道中188号金龙中心17楼1701室