作者:Carlo Passeri & 季渊

Carlo Passeri 先生为大岩资本姊妹公司Jasper Capital HongKong公司的产品和投资者关系主管。季渊先生为大岩资本的执行总监、投资经理。原文标题为: DMA Back In Play(券商交易系统外接重启)。

編者按:

通过算法交易等方式,可以实现相对高频的交易,具有较高换手率。基于高频交易在A股市场上可以实现的假设,本文探讨如何用高频交易因子信号产生ALPHA以及在进行高频交易时进行交易成本控制。本文指出,换手率与高频交易信号存在线性正相关关系,可构建高频交易相关因子来创造ALPHA,提高业绩表现。从本文成文日期(2019年2月)至今,与从事接近高频量化策略的同行交流时,发现今年6,7月的策略表现相对于之前月份有显著下滑,而这两个月交易量也正是从2月以来最低的两个月,与本文观点基本一致。当然策略的拥挤则可能是另外一个重要原因。

为便于原汁原味体现文章内容,敬请读者阅读下文。原文为Jasper Capital HongKong公司newsletter之2019-2月号文章,转载时略有删减。

DMA Back In Play

As many of our investors may recall from our conversations and letters, one of the State Council’s main objectives this year is to improve financial market functioning via improved supervision, less-restrictive policies, and, naturally, to further open financial markets. We got the first taste of this in February, when Yi Huiman, the new head of the CSRC, outlined some initial plans. One policy stood out to us—the desire to revive direct market access (DMA), which will once again open the door to high frequency trading (HFT) in China.

This policy, which we expect may be approved later this year, will allow us to execute a suite of methods to increase our excess returns. In this monthly, we will discuss high frequency trading in the A-share market, how Jasper Capital already capitalizes on HFT to generate alpha signals, and how we plan to implement HFT, once approved, to implement more advanced transaction cost models.

History

The history of high frequency trading in China is similar to that of any other crisis-era policy; a severe overreaction made without all the information that has led to unintended consequences. In response to the market rout of 2015, Beijing severely overreacted by literally pulling the plug on DMA connections, effectively eliminating algorithmic trading in A-shares. This has made the market’s mechanism for price formation less efficient, compounding the negative liquidity effects already existing from the ban on short-selling. This structural shortcoming in market liquidity creates disadvantages vis-à-vis other markets, such as creating systemically higher transaction costs.

But people will find a way, and the industrious culture of onshore capitalism indeed has. These days, “HFT” trading consists of trading an existing long book intraday and never going below starting position sizes. These “HFT” variants performed well last year, with some firms returning upwards of 30%. However, as in nature, the consequence of speed is size. Most of these funds cannot scale and top out at less than $10 million.

Application

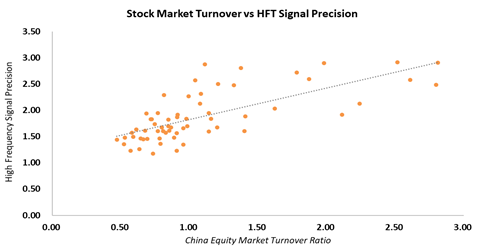

We have deconstructed the behavior of various specialist funds to develop signals predicated on minute-level trade flows and tick-level data combined with other sources to forecast the patterns of these institutions, which include HFTs. Various permutations are thusly derived taking momentum and mean-reversion tendencies of these iterations into consideration. Yet, as with almost everything in the A-share market, the consistency of signal performance predicated on market technicals and trade flows at a certain frequency relies heavily on volumes, as demonstrated in the chart below where we compare onshore exchange turnover ratio to the precision of Jasper HFT signal (measured as a modified adjusted R-squared between the signal and model returns).

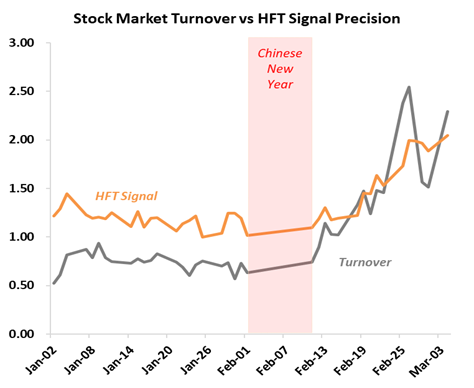

Hence, as trading volumes increase the ability for our signal to accurately predict expected returns increases, enhancing our return profile. It has the added benefit of providing a diversifying alpha signal to our library and integrated model. As the chart the below demonstrates, the predictive ability of another one of Jasper Capital’s HFT-derived alpha signals has incrementally improved since the start of the year as we continue to fine-tune it.

For example, we have taken our methods a step further by taking these HFT signals, and their components, as inputs into machine learning models to develop lower frequency signals, which are proving quite robust in backtesting. We hope to deploy these signals in the coming months.

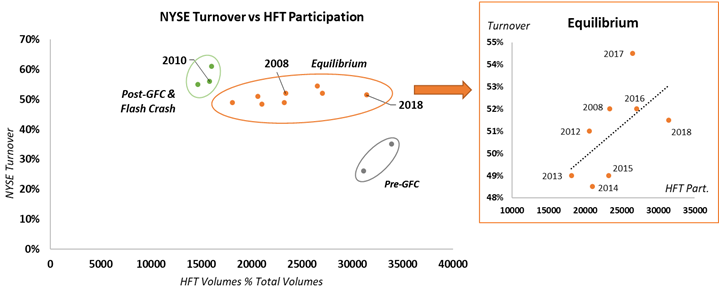

We continue to develop newer signals from these recently created signals given the Chinese market is rapidly evolving with more participants entering the onshore market. This begets the question of how long one can expect HFT signals prove resilient and, most importantly, profitable? Using the experience of the U.S. market, there is an equilibrium level that is eventually found. TABB Group’s annual data going back to 2006 on high frequency trading volumes on the New York Stock Exchange (NYSE) suggests that an equilibrium level can be found in the 51% +/- 3% of average daily trading volume range. So, HFT in China has more room to run, but its path will by no means be linear, compelling us to continue to evolve our signals to ensure that we capitalize on as many opportunities as possible.

But we foresee HFT algorithms having a more fixed position as a method in our transaction cost models to reduce slippage. Currently, we can expect to experience around 10 basis points in slippage versus daily volume-weighted average price when trading A-shares onshore due to the inefficiencies mentioned at the start. Our experimentation with higher frequency trading algorithms for order execution has dramatically reduced these frictions. Furthermore, Jasper’s experimental market neutral strategy that employs algorithmic trading strategies showed a positive contribution to excess return from slippage, illustrating that we can not only limit costs but effectively have positive contributions to returns from these techniques.

深圳市福田区益田路5033号平安金融中心88层01单元

上海市浦东新区陆家嘴街道富城路99号 (震旦国际大楼)27层

香港中环德辅道中188号金龙中心17楼1701室